Skrill Charges For Deposit

Skrill usually charges 1.45% of the transfer amount for sending money to another Skrill account, but this can vary by location. Direct deposits to bank accounts via Skrill are free though. Skrill also charges a 3.99% mark up over the Reuters exchange rate if you’re using “Skrill to Skrill” for international payments. .Annual fee applies. From April 27, 2021, an application fee of $10 will be introduced for customers who do not meet certain criteria. For more details see here.Skrill may make money on the exchange of currencies, when sending money to a non USD denominated Skrill wallet.

- Using your Skrill wallet online? Free.

- Receiving money from a friend? Free.

- Uploading funds? Free.

- Sending money to an e-mail or Skrill wallet? That’s free too.

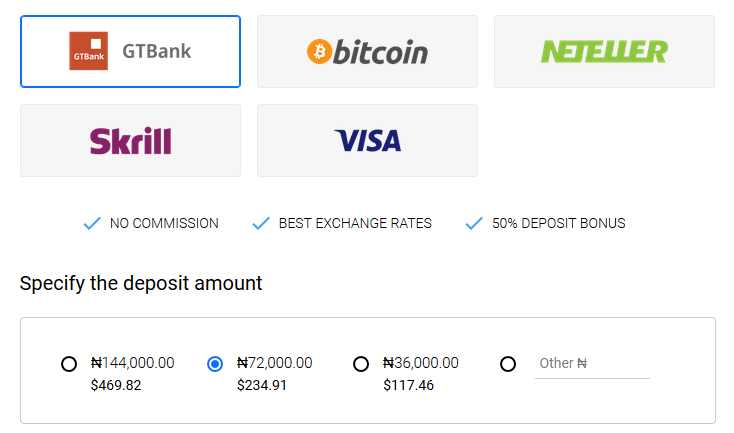

Local payment methods

Global payment methods

Please note that if you use your credit card for gambling purposes your issuer may charge a ‘cash advance' fee. This fee is outside Skrill’s control, and we receive no part of it.

Global payment methods

Skrill Money Transfer

International transfer

International transfer in the same send and receive currency only

Up to 4.99%Send money fee per transaction.

International transfer exchange rate mark-up

Up to 4.99%Exchange rate mark-up fee per transaction.

Receive money

Free!Skrill Money Transfer does not charge recipients any fee to receive.

Skrill to Skrill

Free!Receive money

Receiving money is always free of charge

You will see the applicable fee before you complete your transaction.

Skrill Charges For Deposit Transaction

Keep Skrilling

Your Skrill Account is free for personal use as long as you log in or make a transaction at least every 12 months.

If you don't do this, a service fee of USD 5.00 (or equivalent) will be deducted monthly from the funds in your account.

Skrill Charges For Deposit Paypal

For transactions involving currency conversion Skrill adds a fee of 3.99% to our wholesale exchange rates. The exchange rates vary and will be applied immediately without notice to you.